Pleasure Duration Per Calorie, 7.5 Minute Per Day Bodybuilding, 60s French Toast, and more

This is the complete output of 2024’s studies and ideas. Enjoy.

News

Efficiency Is Everything is looking for a part time Website Director, responsible for legwork on articles, books, webpages. You will have a chance to research your own Life Industrial Engineering studies. Looking for an Efficiency Is Everything fan with MBA or equivalent. Email michaelkirk@efficiencyiseverything.com

Where have I been? Programming automations. It is more Economically Efficient than Industrial Engineering. I have more money now. Hopefully that can explain the Website Director posting above.

I continue to automatically think and study Life/Home efficiency. I have been trying to make 60 second meals and optimize Pleasure Per Pain. Here are the finished studies for 2024:

Quality of Life

Pleasure Duration Per Calorie: Comparing various foods and consumption methods to get the most Pleasure per Pain of food.

Time Saving

7.5 Minute Per Day Bodybuilding: Complete an intermediate bodybuilding program in minutes a day, get healthy, get good-looking, make more money.

Fastest Ways To Lose Weight: Compare Fasting to Exercise, no magic here, just calories burned per day. It makes me want to fast and exercise, but not waste time on walks while eating at maintenance. Goal is to be miserable for fewer days.

Automatic Fish Tank Cleaners: Plants. I can attest to this being a 5/5 quality of life improvement if you are a fish tank owner.

ChatGPT to Save Time: Personalize diet choices, plan parties and decorations, and get quick feedback on low stakes professional questions.

60 second ‘French Toast’: I was told I’m not allowed to call this French Toast, but once you dump syrup on it, does it matter?

Save Money

Thrift Store (Date Night) To Save Money on Clothes: Need clothes but don’t have the time? Have a partner that would enjoy the surprise of finding a cool piece of clothing? Want to save money? Friday Night Thrift Shopping.

Buy Nothing Facebook: For Free, my wife has cleaned and cluttered our home, gotten clothes, Halloween outfits, and more from Buy Nothing. This one is from Mrs. Efficiency, Dr. Mandy Kirk.

Onto 2025

My biggest ask is to tell your friends about Efficiency Is Everything, or share it. Hopefully that is easier than spending money. Plus you will look super cool and smart for Min/Maxing life.

Our collection of Human Life Industrial Engineering knowledge grows.

Best Regards,

Lead Engineer

Michael Kirk

Pleasure Duration Per Calorie: Get the most pleasure for the least pain

The Epicurean Philosophers advocated for reducing pain and increasing pleasure. I had this in mind when choosing between my kid’s Halloween candy. I could have a candy bar(100 Calories) or sucker(60 Calories). I would finish the candy bar before we even got to the next house. I chose the sucker and it gave over an hour of pleasure, and I didn’t even finish it.

This study aims to find optimal solutions. After completing this study, my nighttime snacks have completely changed. They are less calorie and way sweeter than previous.

Objective Data

It is impossible to get objective pleasure data at this time.

To simplify this problem, we start by looking at only 2 objective measurements: Duration of Food Consumption and Calories.

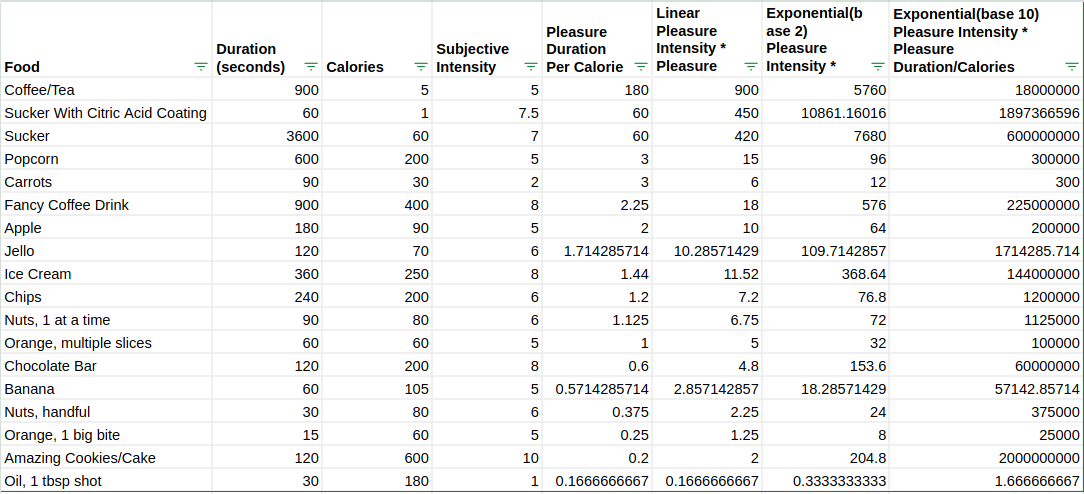

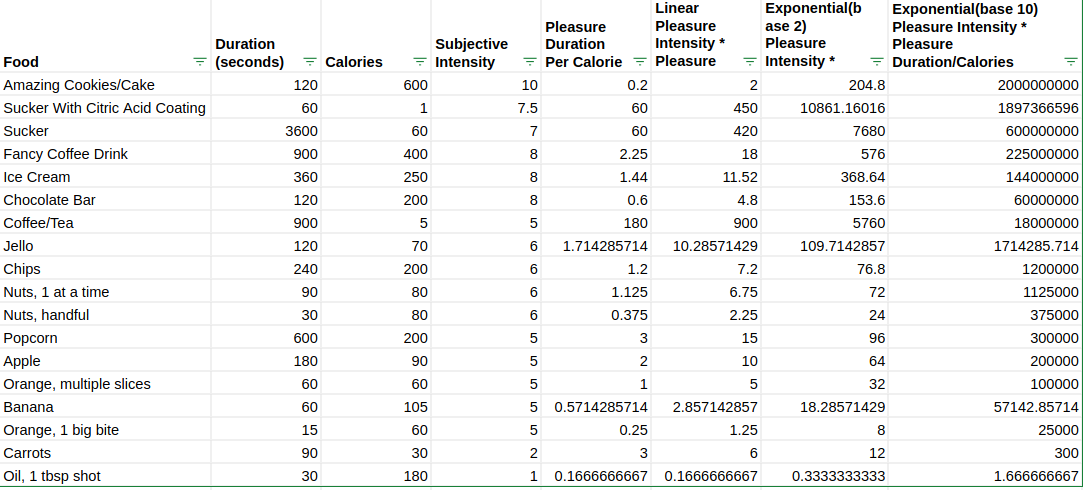

This next data does not consider pleasure intensity, only the “Duration of Pleasure(s) per Calorie”:

The conclusion here is to eat foods as slow as possible, but the foods more generally:

- Suckers

- Vegetables

- Fruit

Adding in Subjective Data

Do you agree with this statement? “A 5/10 pleasure and a 6/10 pleasure are more similar in intensity than a 9/10 pleasure and 10/10 pleasure.”

Because we don’t actually have pleasure measurements and the scale doesn’t seem to match a linear understanding of pleasure, I used an exponential base 10 to multiply by Duration/Calorie for the next comparison. You can also find Linear, Exponential(base 2) and Exponential(base 10) sortable at this link here.

Exponential(10^Pleasure Intensity)*Pleasure Duration/Calories:

My knee jerk conclusion was: “If you are going to treat yourself, treat yourself”, but that was too simple and doesn’t actually solve the original problem.

My thought was to combine the two pieces of data and select items that showed up on both lists.

Data Based Conclusions: Suckers, Coffee, and Tea

From this brief study of favorite foods, Suckers, Coffee, and Tea came out as most Efficient Pleasure Per Pain.

Give these conclusions, what happens next?

Instead of munching on Apples and Oranges at night, have a sucker? I believe it. I eat healthy the rest of the day, if I’m looking for something in the evening, its not typically for nutrition.

I believe its not recommended more than a few cups of coffee a day. However if you have diluted coffee or interesting teas, you could ‘Chain-drink-coffee’ all day. I can attest to this being a constant source of joy. Its probably the caffeine more than the taste, but I find myself excited watching the coffee brew and happy to burn my mouth on it. Pleasure Per Pain, its hard to beat coffee when you have a caffeine addiction.

Eat Your Food Different For Extra Pleasure

“How many licks does it take to get to the center of a tootsie pop?” Licking food is different than swallowing it. It is time we highlight different consumption methods.

Opening an orange into its peals is going to give you extra length over shoving the entire thing in your mouth. I have cut up candy bars into tiny bites to extend it, I justify as it gives more surface area.

Having a stick on Hard Candy/Suckers allows you to rest your taste-buds for later. You can coat/dip Hard Candy/Suckers in citric acid for a different experience.

You can make your own hard candy, this novelty might be interesting on its own, I’ve had fun making ‘craft caramels’. 1 tbsp sugar + 1/4tsp milk is ~60 calories and I can play with this for 30-60 minutes.

Final Thoughts

While I think Coffee/Tea + Suckers are interesting takeaways, I want to emphasize the general idea here: The ability to enjoy a food is independent of its caloric value. You can find more and less optimal foods.

Next time you are going for a snack where nutrition wasn’t the primary concern, ask yourself: Do you want pleasure? Is this the most Efficient Pleasure Per Pain?

Using ChatGPT4 to Save Time

Some ideas on how to utilize AI to save time.

As a note, this is only tested on ChatGPT4. One time ChatGPT4 was down and I ended up going to Google’s Gemini to do the work, it was alright.

Food

Want to start eating healthy or a specific diet, but not sure what to buy? Ask

I am *insert Keto/Vegetarian/Gluten Free/Low FODMAP*, what can I buy at *insert restaurant*

I am *insert Keto/Vegetarian/Gluten Free/Low FODMAP*, what should I buy at the grocery store this week?

I am *insert Keto/Vegetarian/Gluten Free/Low FODMAP*, what snacks that don’t require refrigeration can I buy?

Ask ChatGPT how to modify a recipe according to whatever you want. I will warn you, this is probably best for seasoned cooks because it can occasionally give bad advice like add way too much soy sauce (or at least that seems far too much to me).

It wins far more than it loses.

Ask it for recipes (No endless scrolling of cooking spam articles!). Include dietary restrictions. Tell it to add extra vegetables. Ask what to do if you are out of an ingredient. Replace expensive/seasonal ingredients.

Party Planning

In moments I can ask:

Give 10 different cuisines I can *insert cook/cater* from and give 3 possible examples of what specific foods and quantities will be needed for *insert number of kids and number of adults*.

It gives a bunch of ideas, no brainstorming time needed.

Then ask:

I want the theme to be *insert theme*, what are 20 extremely easy, fast, and simple ways to decorate?

Finally, whenever a crisis happens, ask ChatGPT for advice, there might be a simple solution.

Watching/Answering Children’s Questions

My kids ask a lot of questions, and since ChatGPT can understand phonetically spelled words, my 4 year old can ask ChatGPT questions. It’s similar to a Google/Siri thing, but there’s a higher level of detail in output. I specifically have a bot that tells ChatGPT that they will be talking to a 4-year-old who spells things phonetically and that the answers should have simple words.

Law Questions

While this isn’t for high stakes things, I feel comfortable asking ChatGPT about low stakes legal questions. I’ll often read some document and not understand a sentence. I could just ignore the problem and sign anyway. I could pay a lawyer $100-$200 to read it. I could ask ChatGPT and confirm my understanding with further reading. The nice part is that ChatGPT is awake at 4am when I am working, my lawyer isn’t awake until 8am and my $100 question is small fries to them.

Medical Corruption

Avoid unnecessary medical procedures, ask ChatGPT before you are billed and waste time on unnecessary treatment. As an example, I had a stomach bug and the nurse was pretty pushy about an x-ray. I told ChatGPT about my symptoms and it thought the x-ray was unnecessary. An anti-biotic later, I feel great. No x-ray needed. (I then listened to this nurse go down the room and ask everyone if they wanted x-rays for any condition imaginable).

Car Repair

Confirm that what your mechanic is saying is true. Ask ChatGPT to confirm everything from diagnosis, pricing, etc…

Bots

You could turn all of these questions into ‘Bots’. Bots are literally copypasting your question/prompt/command before you send your new question. You could do this manually by… copypasting your question/prompt/command before sending your question. For instance:

Always copypaste this:

“You are a master chef and come up with ultra healthy recipes that are filling, high in protein, high in nutrients, and easy to cook. Come up with simple recipes I can make up at home”.

Then type whatever you want after before hitting send.

“I want 3 meals that only require a few ingredients from the grocery store”

Then you get a customized answer.

The ‘bot’ thing, is saving the pre-prompt in the ChatGPT4 system… Yeah, they copypaste for you. Its actually kind of nice 🙂

Final thoughts and tips

I often reply to AI with: “That was a 2/10 answer, give me a 10/10 answer” or “Be realistic, not idealistic”. These really do work, the technical term is called Chain of Thought.

Application is up to you. You will get better at asking AI questions.

7.5 Minute Per Day Bodybuilding Workout (And make more money)

Due to miscommunication, one of our Efficiency Is Everything creators thought I was doing a 5 Minute Per Day workout. When I corrected her, she mentioned: “A 5 minute per day workout would be really cool”. (Note from the Editor: I personally would want to warm up and cool down, but the purpose of this article is efficiency. Add a warm-up/cooldown and you can still get in a quicker strength workout).

I couldn’t get it down to 5 minutes, at least not with enough warmups. You might do better.

As a note, given the countless studies suggesting good looks = more confidence = more money, I will propose that exercise is profitable.

Goals

The goals are to be healthy, save time, get stronger, look good, and make more money.

On Being Healthy

Don’t get injured, the weights are heavy and typically done to failure. Two suggestions: Be conscious of form by ensuring the targeted muscles are getting hit rather than joints or unwanted muscles. Stop when you feel pain. (You already got stronger this week, come back next week)

On Saving Time

Be deliberate. If your goal is to get in your workout and save time, look at the biggest sources of waste. A 20 minute drive to the gym would justify doing 2 of the lifts in a single session. How long does it take to get dressed/ready for the gym? Can you do warmups more efficiently?

On Getting Stronger

Each week the goal is to move up in weight, or do more reps. You will get stronger if you do this. To ensure this happens, record your weights somehow. I use either pen and paper or Google Sheets on my phone.

On Looking Good/Make More Money

Muscle looks good. Combine this with eating right, higher protein diets, potentially alternating between bulking(excess calories) and cutting/losing weight.

Good looks will help you do better in interviews, performance reviews, and general conversations with everyone you encounter.

The Workout

The classically recommended Bench, Deadlift, Overhead Press, Squat. 1 per day, 1 heavy set, 4 times total per week. Each lift is done on a separate day, the advantage here is that you rest during your day, rather than between sets at the gym. This isnt significant and if you want to stack Bench and Deadlift on the same day, and Squat and Overhead Press another day to avoid traveling to the gym, it could be more efficient. With a home gym, the rest time is greater than the time it takes to travel to my weight set.

Lifts

I recommended the classic 4, but feel free to add and subtract as you see fit. The process/system is important. Although there is a reason these 4 are classic, they are good. For vanity reasons, I added bicep curls as an additional day.

Reps, Sets, Weights

Whatever you do, you want to keep close to 0 strength left in you. This means you will *always* need a spotter for bench; you cannot do this program without a spotter on bench, because you will be failing.

Sets: the less warmups the faster, the more warmups, the better your performance. You warm up to 1 final set, it’s the heaviest and you will do enough reps to fail or be close to failing.

For bodybuilding, I like eccentric/negative training. Where you do ~8 reps, but you count for 6 seconds doing negatives.

For strength, I like warming up to a single heavy set aiming for 2-5 reps.

Real Life Notes

The first time you do the routine, you may or may not get under 7.5 minutes. Maybe it’s due to having to create a brand new Weight/Reps sheet, or not finding the clips.

You will want to work fast, everything should be more upbeat than normal.

Find ways to reduce transportation time. Driving to the gym is never going to hit 5 minutes/day. This is nearly exclusive to the home gym crew. However, you can see there may be applications of a quick workout in a gym setting. Given the friends and connections I made at the gym, I frequently consider getting a membership for social rather than health reasons.

Efficiency Kandice insists on this: Disclaimer: Efficiency is Everything is not a physician or healthcare provider. This article is for general information purposes only. Follow this exercise regimen at your own risk.

Save Time With Fish Tanks

Our Efficiency Assistant had some ideas for saving time caring for fish tanks. When she mentioned plants, I personally could attest to how much time this saved.

Efficiency Abigail:

There’s something magical about watching colorful fish glide through the water, however I knew I didn’t want my tank to become an overwhelming time suck. I researched and researched, discovering a few tricks to save time, money, and stress.

Here are my top three tips for creating a thriving, low-maintenance tank.

Choose the Right Tank Setup

A well-prepared tank makes everything easier. I started with a 10-gallon tank – it’s big enough to create a stable environment without being overwhelming to care for. I cycled my tank for almost three (3) months, prior to adding any aquatic life. This helped my tank to build up beneficial bacteria that will keep the water healthy. For filtration, I swear by sponge filters. They’re budget-friendly, easy to clean in between your water cycles and a deep clean of your filtration system.

Focus on a Self-Cleaning Ecosystem

What really saves me time is focusing on a natural setup. Live plants like Anubias and Java Fern have been game-changers for my tank. They improve water quality by absorbing toxins and reducing algae, which means fewer water changes for me. Combining these plants with natural cleaners like algae-eating fish and scavengers creates a balanced ecosystem.

Efficiency Michael Kirk: We have also added plants to our tank, we got some from friends who said their plants had grown too much.

Pick Hardy Species

My tetras, grouped as an all-female “Cheerleader Squad,” thrive as social creatures. African dwarf frogs delight me with their antics, while a Rubber Lip Plecostomus and my Nerite Snail handles cleaning the glass. There are two Albino Cory Catfish which love sifting through the gravel and sand for leftover food.

Easy on the budget and relaxing

Fishkeeping has become a relaxing, budget-friendly hobby for me. With the right setup, hardy species, and natural cleaning methods, my tank practically cares for itself.

60 second “French Toast”

It seemed my friend and the social media world was appalled, but they didn’t taste it.

Imagine doing the following first thing in the morning, upbeat and as quick as possible.

Or whenever.

The Process

Get a plate, a bowl and a fork, Eggs, Bread, Cinnamon, and nonstick spray. You should do this along the path of your kitchen in the most efficient way possible.

Crack 1 (or more) eggs into the bowl and whisk

Spray plate with nonstick spray

Dip both sides of bread in the egg. Place on plate. Repeat for all bread.

Shake cinnamon over top, put in microwave long enough for the egg to cook. Probably 75 seconds for 1 slice, 2 minutes for 4 slices. I don’t mind overcooking.

Go do something else while waiting

You have about 2 minutes of microwave time.

Grab the syrup, clean up, answer text messages.

Enjoy

Coat in syrup and eat. It might not be the exact texture you expected, but I am sure it tastes great.

What other corners can be cut in favorite recipes to have them prepared in 1 minute? Hard problem, but I’ve seen it work.

Thrift Store (Date Night) To Save Money on Clothes

I consider this quadruple-Efficient. You go on your date. You multitask and get clothes for the upcoming season. You save money on clothes. You get pleasure from the gambling aspect of randomly finding something good.

My credentials on this topic: I got into fashion for a minute, I can make my own clothes. I can afford any brand. Thrift store clothes do the role. Not only do they have brands for status-seeking people, but you can find nice fits which is most important. LPT: Think of the entire outfit.

How To

Go to a thrift store with your date, pick and try on clothes. I will explicitly mention here: you should be social with your date. But it’s tempting to divide when you see something cool.

Pick clothes that you need. I currently have enough dress shirts, but it seems every year I need new short sleeved shirts. Whatever you need, you shop for.

Efficiency Creator Kandice: Accessories – you could find some hidden gems here. Belts, gently worn shoes, bags for the ladies, and designer items too. It is worth finding designer items at these shops, when you can. Some people make a living off of thrifting and upselling. But besides the potential side-hustle, a designer bag is likely to last you more uses per-dollar than buying a dupe off Amazon or Temu. At a thrift store you’ll pay a fraction of the price if you can find the real stuff.

Tips

You might want to do research and make sure you are going to a Thrift store that gets nice clothes. It’s worth trying a few.

It might be worth putting a cap on the amount you want to spend, we usually set it at like $30 unless something crazy happens.

Look for stains. Try everything on.

Wash everything.

Final Thoughts

The “good problem” with thrift stores is that they have stuff that you will really like. The problem is they have one. You literally cannot buy two of the same shirts.

I hope you also can enjoy the phenomena of enjoying a thrift store purchase a bit too much. For that reason, I still buy many clothes at the regular store. This is a good first stop, and the randomness makes it fun.

Buy Nothing

Efficiency Michael Kirk: My wife, Mrs. Efficiency/Dr. Mandy Kirk on her own:

Save Money, Reduce Clutter, Meet Neighbors, Be Environmentally Friendly

Looking to save a decent amount of money? Want to clean out your house of the clutter that compiles with time? Want to meet your neighbors and save the landfill from being overloaded? Then Buy Nothing groups are for you.

If you haven’t heard of Buy Nothing, it is a community founded on gives, asks, and gratitude. It is organized by Facebook groups local to cities. There are some cities that don’t have them and are grouped into other cities, or if you’re in a rural area you may not have them at all. Most major cities have a Buy Nothing Facebook group associated with them. My city has 4 Buy Nothing groups, dividing the city into quadrants to keep things a bit more local – I’m in the Southwest group.

How It Works

On Buy Nothing Facebook groups people will post items that they are getting rid of for free (gives) so that others can pick them up from neighbor’s porches instead of the trash.

People can also post asks, things that they want or are looking for so that people who have extra can give them to them. All of these items are FREE, which leads to gratitude and increased community togetherness besides the money saving aspect.

My Non-Item Wins

Since I joined Buy Nothing, I’ve learned the geography of my city and met a lot of my neighbors and created friendships.

I’ve had the added perk of expanding my business and gaining new patients from the community, since they are more likely to go to a local physical therapist who they have met.

It’s made me appreciate my community more and restored my faith in humanity to a certain degree.

I’ve been able to clean out my basement and closet when I was nesting and know that my items were going to good homes.

Of course I’ve decorated my house and clinic with gives.

My Favorite Items

Some of my favorite items received:

- A coffee table and two beautiful matching side tables for the clinic

- A treadmill

- Plant clippings and planters

- Tomato and pea seedlings

- Halloween costumes

- Snacks for my kids lunches that I may not have spent the money to try

- Hands free breast pump to try to increase my supply while working

- A small bookshelf and storage area for toys, clothes for myself and my kids as they size up.

Sometimes even things that I thought no one would be interested in (half used lotions, leftover food from a party) gets snatched up pretty quickly! It’s nice to know anything can be put to good use.

The Only Negative: Transportation Waste

The only negative I can see of Buy Nothing is potential transportation waste. Driving all over the city and wasting up to 15 minutes each way on transportation time and gas can add up. There have been occasions when I make a drive out and then the person forgets to put the item out and I have to make a second trip.

My recommendation is to look at cross streets of items and judge for yourself if the value of the item is enough to you to make a trip out of the way. I am more likely to pick up small things in my neighborhood and on my way to work, and if I’m going out of my way I try to stack multiple pickups on one day or only get large or expensive items.

Try it

Low stakes, high reward. Go to Facebook, search “Buy Nothing *your city name here*”, join the group, and scroll to start. See what people are asking for and giving. Find something you like, comment on why you’d like it. The more personal the better odds you are selected, give a reason.

Wish you best luck on getting and getting rid of items.

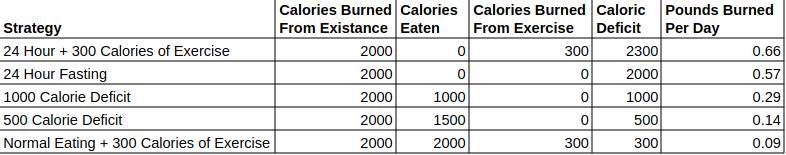

Weight Loss Per Day – Fasting, Exercise, and more compared

I don’t think anyone will be surprised to see “Not Eating” + “Doing Exercise” is the fastest way to lose weight. However the noteworthy comparison is the Efficiency of weight loss. This can be used to limit the pain needed to lose weight.

There are plenty of websites about fasting for multiple days, look into those or the Electrolyte loss + Refeeding Syndrome can kill you.

Data and Findings

Fasting with exercise wins, this is easier said than done if you’ve fasted for a few days. I’ve been able to run ~1 mile and walk 2-3 miles during a 5 day fast. This is approx 300+ calories.

Something interesting here. The extra exercise is gives you the same weight loss per day as if you never fasted, however the absolute when fasting is higher. Its easy to dismiss this as obvious, but if you ever found yourself buying an extra item because it was Buy One Get One Half Off and you ended up spending 50% more money than you expected. My point being: If you are going to be suffering during a fasting day anyway or its urgent to lose weight, you could add an extra 300+ calories in exercise.

This also highlights how insignificant some exercise is. 1 hour of causal walking burns ~300 calories max. It is quite time intensive to burn calories this way. Meanwhile if you could run 6 or 13 miles, you could be burning 800 or 1700 calories in a day. These stacked with a caloric deficit can get decently high in weight loss per day.

Personal Application

If you can handle fasting, it clearly shows to be the best. I will do this a few times a year for ~2-3 days to lose weight but not get into ketosis. Being obsessed with Efficiency, I admittedly will do sometimes a 1 mile run then take the kids ~2 miles round trip to the park.

More regularly, I’ll eat 1 large-ish meal and 0-1 smaller meal/snacks through the day. Then I’ll do some cardio, often 6 miles. 1500 calories eaten, ~800 calories burned. 1800 Caloric deficit! Lose a half pound in 1 day!

This is semi-reasonable to do this and similar all week. Swapping 6 mile runs for biking to let muscles rest won’t burn as many calories, but it will give you a break and still burn extra.

Final Thoughts and Long Term

I consider losing weight a temporary condition. I don’t plan to live like this forever. I plan to lose the weight and stay some-what around that weight.

If I gain 5-15lbs in a year, I can lose this weight in weeks. This can beat some of the mental difficulties with weight loss. We are often inspired for the first ~2 months of a new lifestyle before the excitement is gone.

Apply this law of nature and sprint at weight loss for 2 months before taking a break and eating normal. When you are excited to take on another round of weight loss, you are ready to begin.

1 Minute Races, Baby Time Tips, Fast Food Alternatives, Cardio Exercise Per Dollar

Huge Sale, $10 for our Speed Cooking book, down from $35. If the sale doesn’t show up, wait ~72 hours, I just posted the sale a moment ago.

I’m happy to say that we have lots of novel time saving ideas. Maybe that whole ‘be a master with 10 years of practice’ is real. I’ve been doing Industrial Engineering for 9 years now and I have a tool to present this release: 1 Minute Races. See below.

Save Time

(Feature) Stop Trying So Hard And Save Time By Eliminating Overprocessing Waste – Do you know what overprocessing waste is? If not, you are probably wasting and not realizing it. This goes around the home and looks at areas you may be wasting time.

(Feature) Save Time With 1 Minute Races– This is new technology! This tool can be used to drastically cut the time any activity takes. Since discovering this, I look decently presentable when picking up the kids from daycare despite being WFH. (Also, this might be rediscovered technology, the closest I could find was called Single-Minute Exchange of Die)

Create Time With A Baby– A few value added tips that not only improve your life after have a baby, but also give you more time.

Eliminate Baby Waste– Tons of tips on how to apply the 7 forms of waste to getting your baby to toddler.

Save Money

Faster Than Fast Food– Ideas to spend less than 5 minutes per day cooking. Featuring 2 exclusive recipes!

Cost of Exercise Per Year – Looking at various ways to get the heart rate up. I originally called this Exercise Per Dollar, but decided that a per year basis was easier to relate.

(Short)Save $200/yr on Library (audio) books– Don’t bother clicking the link, get a library card, sign up for their online services like Hoopla and Libby.

Final thoughts

Everyone is already using chatgpt right? If you aren’t, that is an easy way to save at least 1 hour per day. I will even recommend the paid ChatGPT4. Practice using it, there might not seem to be a learning curve since its so easy, but your skill with unlock new abilities.

I’ve started thinking about a metric Pleasure/Pain. While this might be able to be measured using neurochemicals and hormones, I think we also can make some sort of personal judgement on these as well. Exchanging rubs with someone costs only time, however adding extra salt to food might even have less pain related costs. I wanted to share this idea, so you can consider this in your own life.

Think throughout the day what tasks can be turned into 1 minute races, its been eye opening how much time you can save when you remove old routines.

Wishing you the best rest of the year. Hope you make goals that help you grow in 2024.

Lead Engineer

Michael Kirk