Avoid the $1,000,000 dollar lifetime 401k mistake- Operating Expenses

This is nothing ground breaking, other websites may cover this in detail, however the sheer amount of money at play makes this incredibly important.

Do you know what your 401k’s Operating Expenses are?

If your answer is ‘No’, this is likely the most important article I’ve written for you. Its also one of the best $/hr savings since you can change this in mere minutes. Want to make $1,000,000/hr? Keep reading.

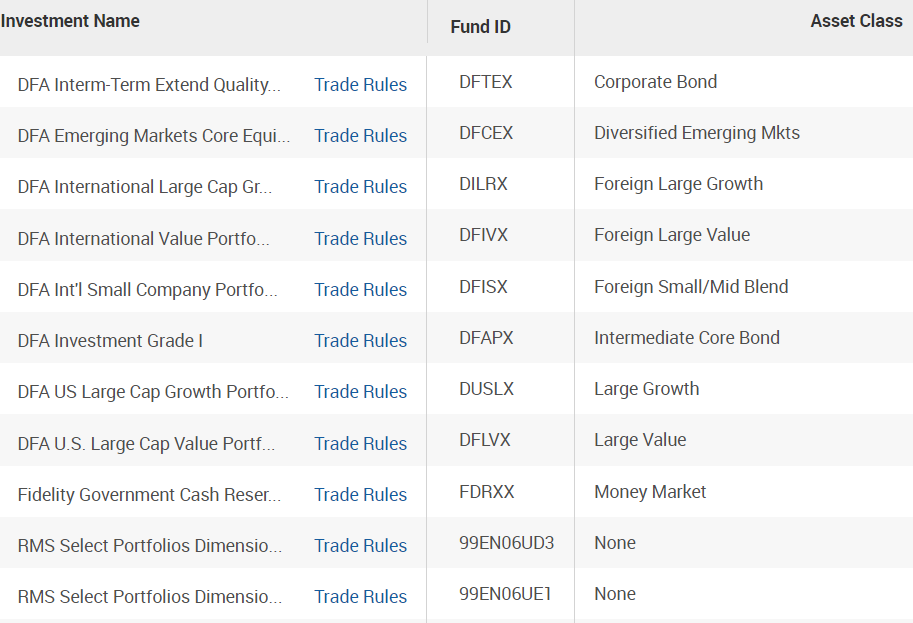

When you signed up for a 401k, you chose various plans to invest your money into. They most likely were classified by risk and had name that describes which assets and what company controls it. Each of these plans have different operating expenses.

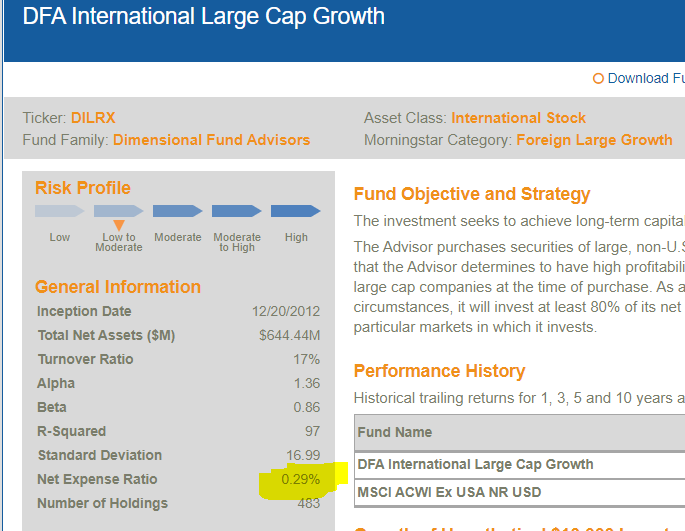

If you look into each plan, you can find things like stock/asset breakdowns, performance, etc… What you are most interested in to save money is the Operating Expense or Expense Ratio which is typically shown as a percentage.

Which plan should I pick?

Up to you really. I’ve seen people laugh at people paying 1% for unmanaged money. Maybe if you find the next Michael Burry, its worth paying 1%. However, if you randomly picked 401k plans with little oversight, it may be better to pick index funds that are closer to 0.1%. Personally the most expensive 401k plan I have has a 0.3% operating expense, and that invests in small businesses.

I’m a huge fan of diversifying and keeping fees low.

How much money will I save?

If you are paying 1% instead of a 0.1% plan for the next 35 years, you are paying something like-

1- (0.991^35)= 1- 0.728= 27% fee for 35 years.

Note that I saw plans as high as 1.3% fees, and you could be investing from the age of 18 years old and withdrawing as old as 115 years old. 62% fee! If you had $5,000,000 in your account, $3,000,000+ would have been taken in fees.

And further, as you make gains in the market, that money goes up in value, so you are paying an even higher fee than mentioned above.

But I need to look up my login/password, research…decision fatigue

1 million dollars. $1,000,000. If you aren’t aware of your operating expenses on your 401k, you can think of this as spending $1,000,000 on the wrong groceries, cable company, cellphone plan, etc… You fix this one time, and you don’t need to think about it again. To update my investments, it took me less than 1 hour.

Reminds me of those meme questions- Would you do X for $1,000,000?

Would you update your 401k plan for $1,000,000?