Rational Decision Making – Picking Your Next Job With Math

Lead Engineer- Michael Kirk:

If you have been staying at a company ‘because the health insurance is good’, you should know the real world $/hr benefit. That good feeling might be a costly mistake.

Data Driven Decision Making

Compensation($), Time(hr), and Qualities make up the various inputs to aid decision making.

Compensation = Income + Benefits + Vacation

There are a few ways to do this, it can be simple, comparing vacation and health insurance benefits. If you will go to college and getting work to pay for it, you can include that too. This should be 0 if you do not achieve this educational goal.

Your total compensation adds up every value you get from a company. These are added up. Some ideas: health insurance(vs healthcare.gov), college(if you actually attend), 401k matching(only if it vests), cellphone, bonus(only if the economy and company is doing good), and think of any possible benefit so you can attach a value to it. There is an opportunity to add subjective values, ie- I like my current job, valued at $5,000.

Avoid straying too much from data driven mathematic to prevent variation and error.

On Health insurance estimations. I’ve found that the best possible health insurance benefit covers everything, worst case ~$9500/yr single, $25,000/yr family. However more reasonably your entire family wont be hitting the max out of pocket each year and this is more like $6600 benefit for a family. If you cant be bothered to go to healthcare.gov and find out how much your health insurance is, you can estimate a number less than $6000. Most people with ‘good’ health insurance plan may save you closer to ~$3000/year vs healthcare.gov.

Costs- Time and Gas Money and Security?

You can include drive time and gas. This would raise your expected ~40 hour/week workload and reducing your $/hr accordingly.

Gas costs can be calculated/estimated to factor an additional expense for distance.

Could you factor in job security? A contract job has a higher risk of losing employment. For example, a GM employee or contract worker has a ’15’ percent chance of being cut. Should you factor this into a job at GM? These are your decisions to make rational job choices.

Real Life Example

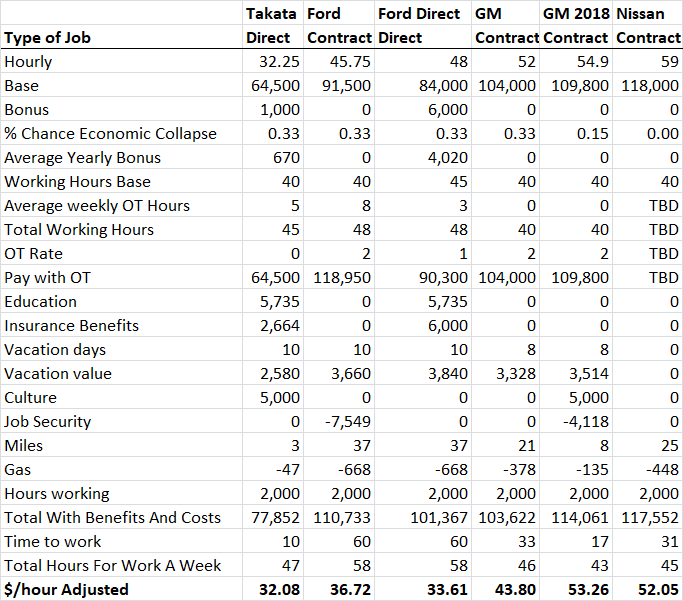

Here is an example to show the possible complexities of this calculation. This could be simpler for your own life. Adjusted $/hr = (All Compensation – All Expenses)/Total Time working+ commuting.

Data and situations are not perfect. Instead of an easy ‘fill in’ the blank, you should consider your situation and put numbers to it. Reminder that this is a multi-thousand dollar per year decision.

This outcome favors seeing the outcome of GM’s 15% cut to its workforce, as the commute and lack of vacation days at Nissan make the job a slight economic disadvantage. The final decision might come down to a ‘better career move’ decision as both jobs are competitive. Adjusted, the difference is only ~$2,500/yr. The career decision would only need to be worth $2,500 more to move to Nissan.

Rational Decision Making

The goal is to get closer to a good decision and notify you of abnormalities. Putting numbers to life decisions will often showcase harsh realities of being incorrect. A previous lifestyle, job, or career could be found to be a worse decision than a new opportunity. A new opportunity could also be a guilty pleasure to run from your current problems. Math can make you aware of these subconscious feelings. Its up to you to decide if that cost difference is worth it.