Too Important Not To Cover: Future Value vs Present Value is a Multi-Million Dollar Decision

Lead Engineer- Michael Kirk:

Some topics are far to critical to Life to remain untouched. Your allocation of resources and assets is a choice that changes your life whether you like it or not.

The goal is to compare various opportunities for Future Value so you can make a decision based on your current life conditions and goals.

Cash on Hand

This is the fancy way of saying ‘United States Dollar’ in the US. This is your combined bank account, wallet, safe, under your bed, etc.. value of USD. This is a special number because the government has the ability to print money, and has historically devalued currency through ‘inflation’.

The US government claims ~2% inflation, others report 4% yearly inflation.

Your goal with excess Cash on Hand is to allocate it outside of USD to beat 2% inflation.

Interest Rates, Risk, Returns

The goal is to beat 2%/year inflation. But you also have other Qualities- Risk and Liquidity(ease of selling)

- Do you need your investment to pay for something soon? If so, less risky and more liquid.

- Do you have a loan? Refinancing is a good option

- Lots of excess income? Gambling vs long term investing.

Safest Asset Locations

A US Treasury Bond returns at 2%/year and would be ‘cost neutral’. Which explains its worldwide popularity. Its safe, it makes money, and it can be liquid.

Hoarding USD is popular, but runs risk of inflation.

Real Estate is popular, but isn’t liquid. Warning, real estate is also work, consider real estate a part time job rather than a passive investment.

Debt is worse than Inflation

Student Loans, Mortgages, Credit Cards. That % interest per year, is your new number to beat. A 4% mortgage means that any investment, should return more than this.

To convert Cash on Hand into a debt payment and make a positive impact on your interest payment, you must refinance. Paying more money each month, makes little to no difference as your loan is the same size. More payments means saving thousands of dollars, rather than refinancing for tens/hundreds of thousands of dollars.

Its best to wait until rates are favorable to refinance.

Unimportant, can skip – A note on Amortization

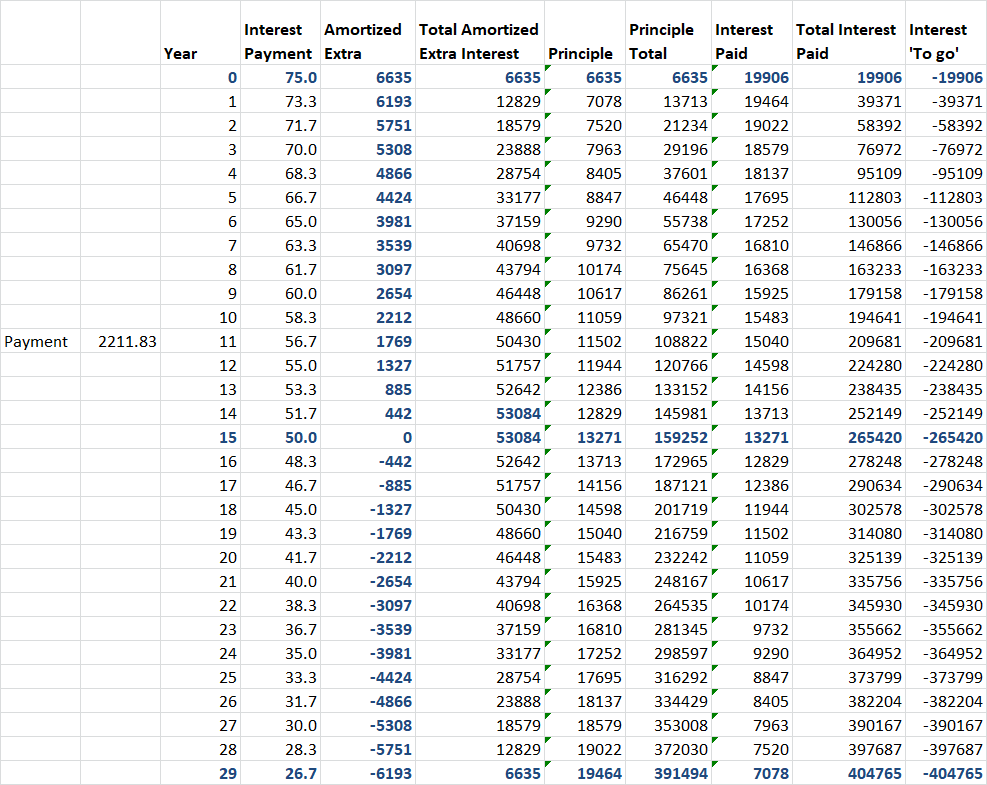

Loans often have an amortization where the first payments are 75% interest/25% principle, and at 15 years in 50/50, and year 29 its 75% principle/25% interest. Refinancing resets this clock, and you do lose a few thousands dollars. We calculated if this is significant and if there was an optimal time.

Note, this is a ~400,000 dollar mortgage:

If 15 years are spent before refinancing and the amortization never works in our favor, we spend over 50,000 USD on amortization. At worst case its about 6% of your mortgage, totaling likely tens of thousands of dollars.

However, after refinancing, you will have saved likely hundreds of thousands of dollars on your mortgage and interest, about 20% of your mortgage.

Very Important- Refinancing

When refinancing(20%+) you will eliminate tens or hundreds of thousands of dollars in future interest payments.

This is why saving up for a large debt payment is a safe way to ‘earn 4% interest’.

Re: Tax Write offs- There is a myth that spending more money on interest can save money on taxes. Your taxes will be slightly lower, but you will have spent more money on interest. Its wrong to spend, to spend for taxes.

Investing/Gambling

Abundance is a strange thing. People of all types are throwing money in investment apps.

As we try to increase our assets, we can try to beat our debt interest or exceed new highs.

Long term, safe, market investing can expect 7-30% yearly returns, or 30% yearly lows. This needs to beat our 4%/yr mortgage interest. Buying on a bad year can be disappointing and worse performing than USD.

Pick your favorite assets that you believe will perform better than USD. It is a good idea to have at least some diversification.

Maxing out your 401k/IRA is a good start. Diversify. Use your experience/knowledge to make niche investment decisions. Gold/Bitcoin. Diversify. SPY. Unicorn Projects. Your own project. Diversify.

The goal is to keep Cash on Hand low, and assets invested either passively or actively. You have millions of future dollars at stake. (But don’t stress, you do the best you can).

Re Gambling: The word Gambling was a misnomer for the unpredictability of investments. Actual gambling? No way, that’s bad math.

Recap- Your Options

You have Cash on Hand that loses value at 2% a year. Beat this.

Treasury Bonds are safe and liquid return 2% a year.

Debt often costs more then 4% a year, whatever your highest debt interest is your new number to beat. Beat this.

Investing comes in many shades from long term index funds vs gambling. This is the risky way to earn money.

Lead Engineer-Michael Kirk:

Given the current economy, we are choosing to save up to refinance. 4% isn’t bad when everything else is sinking.

This decision comes from many inputs, including political climate, like it or not. Your experiences should make an impact on your decisions.

Wish you the best on your asset allocations,

Michael Kirk