Engineering Conclusions on Health Insurance

EDIT 2022:

Somehow we were able to change our health insurance plan mid-year. You might be able to exploit this by choosing a cheap plan for the start of the year, and switching before needing health insurance. That worked for this pregnancy.

EDIT 2021:

A nuance we learned this year, some health insurance companies payout more. For instance, Blue Cross Blue Shield reimburses about $10,000 for 24 hours of labor and delivery. For physical therapy they reimburse $125 for 1 hour. However Meridian paid out $6,000 for the same labor and delivery and $60/hr for physical therapy. This means if you didn’t hit your max out of pocket, Blue Cross Blue Shield has made a deal with healthcare providers to charge you more money.

I’m not exactly sure how to use this yet, but if you are aware of your following year healthcare services, you might be able to compare companies. This doesn’t change much from the article, you’d still pick the lowest cost plan, but compare lowest cost plans between companies.

EDIT 2020:

After multiple years of use, here are a few things we learned-

- Make sure your hospital, clinics, doctors, accept your insurance

- If you don’t plan to get sick/injured, pick the cheapest insurance

- Basic pregnancy does not hit max out of pocket (around 6k)

- If you do plan to get sick/injured, read the rest of the article

This is one of the best articles on this website on how to save money.

Lead Engineer- Michael Kirk:

The data is conclusive, and there is not much room for argument that Health Insurance companies are using marketing tactics against us.

There is almost never a reason to pick an expensive or medium tier health insurance company. Lowest monthly premiums perform best-in-class when it comes to saving money and dealing with catastrophic injury.

If you have a reason to believe gold plans are ever a good idea, -Speak Up-

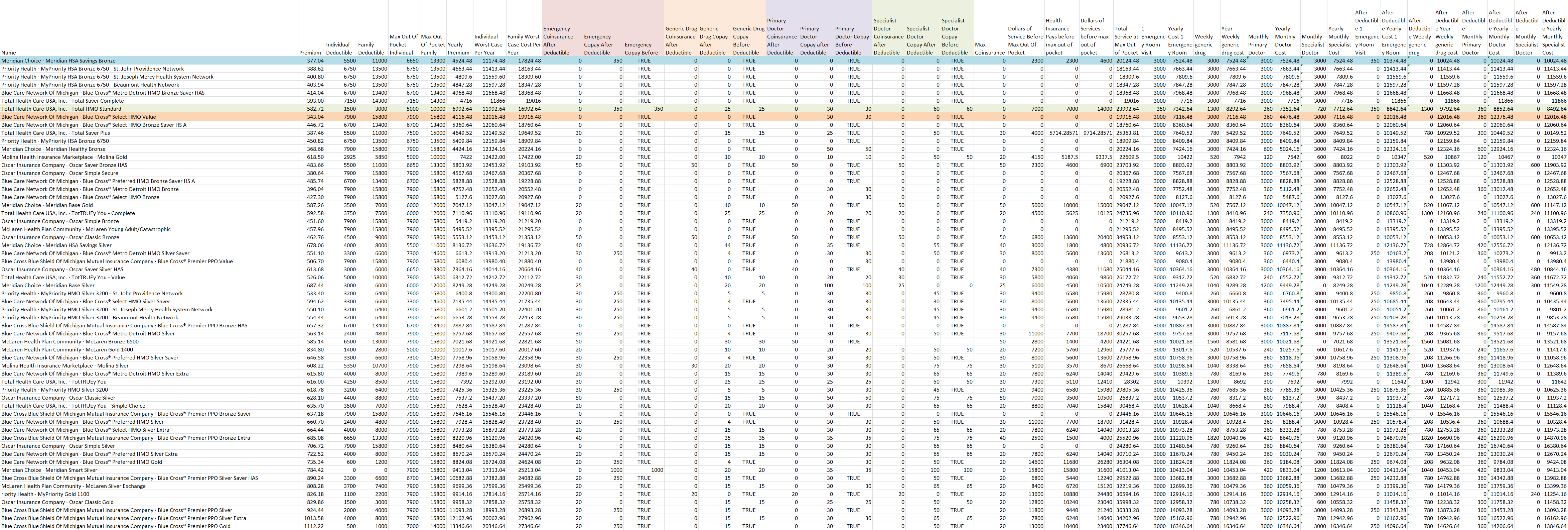

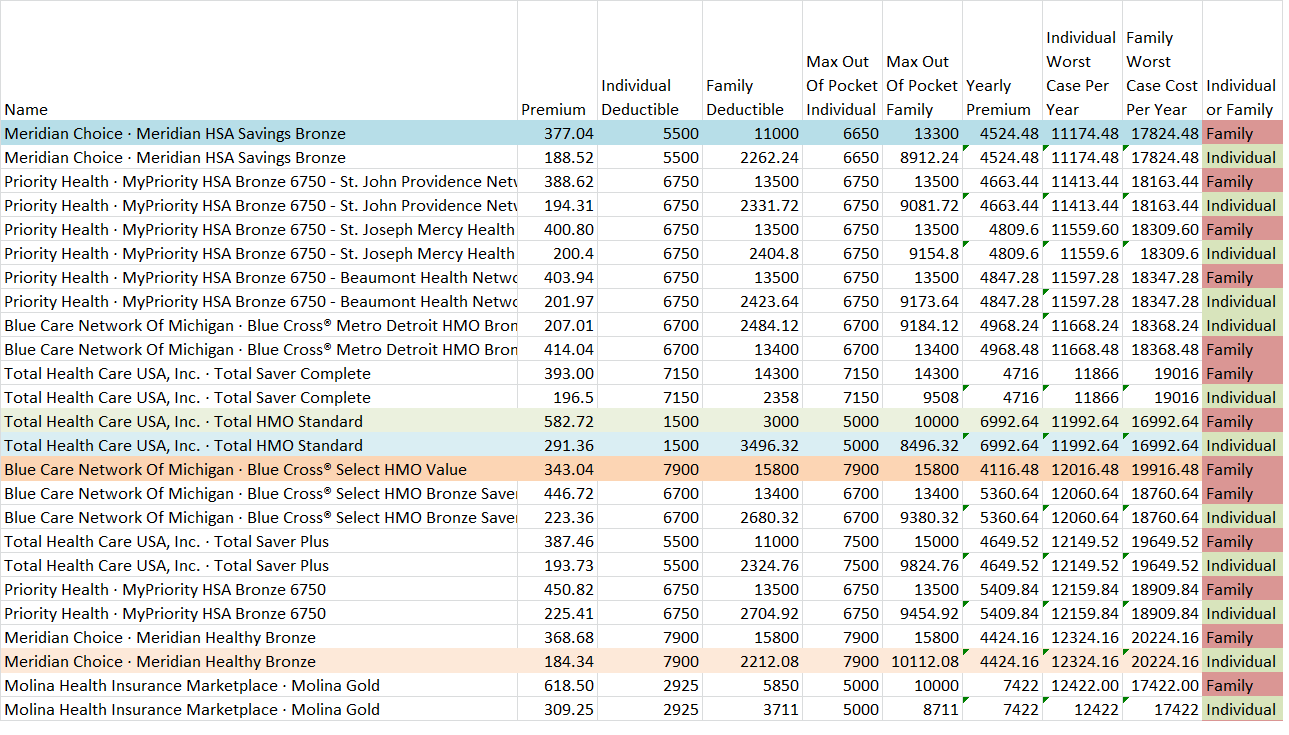

The overwhelming evidence explaining why you should pick low cost plans is about to begin. See how much data was collected to draw these conclusions:

The excel data can be found – Here

Premiums-Save Money Here

For us, our lowest cost plan was $343.04/mo. $4116/yr. If you are planning on staying healthy(and not getting pregnant or sick) your search ends here. Pick the lowest cost plan. At worst, you would expect to pay 12016.48 for an entire year and full medical coverage for 1 individual.

For full disclosure, these are the most expensive plans, even in times of injury and illness.

- Blue Cross Blue Shield Of Michigan Mutual Insurance Company · Blue Cross® Premier PPO Silver Saver HSA

- Blue Cross Blue Shield Of Michigan Mutual Insurance Company · Blue Cross® Premier PPO Silver

- Blue Cross Blue Shield Of Michigan Mutual Insurance Company · Blue Cross® Premier PPO Silver Extra

- Blue Cross Blue Shield Of Michigan Mutual Insurance Company · Blue Cross® Premier PPO Gold

The upfront premiums of expensive insurance plans outweighs any benefits that it claims to have. Paying more money is worse. Fancy names are looking to take advantage of what would appear to be a cautious consumer.

Saving Money When Needing Medical

Consider if you are planning on getting over 7000 dollars of medical procedures this calendar year. If so, there is a slight optimization, and will require basic math to complete for yourself. Here are the results while we expect Mrs. Efficiency to hit our Max Out of Pocket, and myself to stay healthy.

If you skip this step, the difference between our lowest cost premium and our optimization is $842/year. ~34,000$/lifetime.

Do It Yourself

You will need to do the math, Click Here For Our Simple Excel File

Fill in Name, Premium, and Max Out-Of-Pocket. The excel file does math for:

Yearly Premium = Premium/month *12 , Worst Case= Yearly Premium+ Max Out-of-Pocket

The goal would be to get the lowest cost Worst Case.

Deductible, Copays, Coinsurance are Teases

Fancy words, when often the only thing that matters is the premium. Often the US government enforces a cap of $15,800 max out of pocket.

We studied what it looked like to take advantage of high quality health insurance benefits on Emergency, Primary Doctors Visits, Specialists, and Generic Drugs. This data was unreliable from the healthcare.gov website, but we were able to draw generalized conclusions.

Best, Worst Case Scenarios

In a situation where you visit the emergency room once a year, there is are 2 plans that has a copay for the potentially expensive emergency room visit.

Total Health Care USA, Inc. · Total HMO Standard and Meridian Choice · Meridian Smart Silver have a copay before you hit your deductible.

This set of circumstances would cost you 8842.64 per year, given the correct set of circumstances that you aren’t charged for tests, or a plethora of other exceptions.

At risk is ~$3,000 in premiums to have this odd Emergency privilege. Recommendation is the lowest cost premium plan.

Expensive Generic Drugs?

Do you only take expensive generic prescription drugs? No doctors visits, but a constant flow of medically necessary generic prescription drugs? If you don’t plan on hitting your deductible. But if you do plan on hitting your deductible, this would be more expensive. This situation is an ideal fantasy.

Doctors Visits

Continuing this unlikely optimization, Total Health Care USA, Inc. · Total HMO Standard has been quite the situational loophole despite being a decent deal. They have set copays before hitting a deductible.

Reminder that this plan,

- Is 2-3k more expensive Premium per year than recommended plans

- Relies on your physicians billing everything correctly

- Max Out Of Pocket is still higher than other plans

Filing as Multiple Individuals vs Family

Overall, yearly premiums seem to be better for families rather than 2 individuals. This gets slightly more complicated when you offer the ability to have 1 member pick a lower deductible plan. However, even with this, we found that its better or negligible to file as a family in each situation.

Health Insurance 2019

Thank you for reading our guide to selecting health insurance. Reminder that if you find anything wrong, email us at michaelkirk@efficiencyiseverything.com for review.